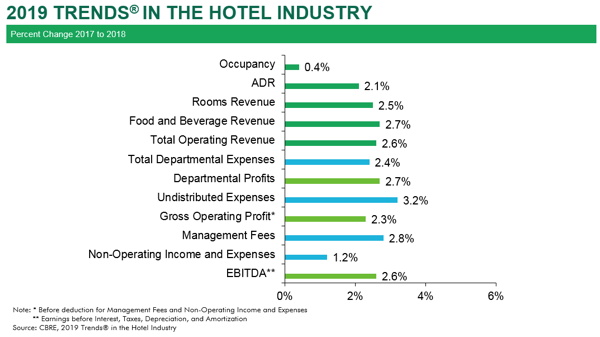

Profit growth for hotels in the United States is becoming more difficult to attain, although hoteliers did enjoy their ninth consecutive year of increasing profits in 2018. That’s according to CBRE Hotels Americas Research’s most recent edition of its “Trends in the Hotel Industry” report.

“With revenue growth forecast to slow down in the foreseeable future, owners and operators are beginning to wonder how much more juice is left to squeeze out of their operations,” said R. Mark Woodworth, senior managing director of CBRE Hotels Americas Research. “2018 marked the first year since 2009 that expense growth exceeded revenue growth, thus resulting in a slight decline in the GOP margin. This is indicative of the struggle managers are having sustaining the effective cost controls that have been in place since the great recession.” In 2018, 59.2 percent of the properties in the Trends® survey sample achieved revenue gains, but only 54.3 percent realized GOP growth.

“Historically, at this point in the business cycle, we see ADR growth that really drives profits,” said John B. (Jack) Corgel, Ph.D., professor of real estate at the Cornell University School of Hotel Administration and senior advisor to CBRE Hotels Americas Research. “With ADR growth limited to 3.0 percent or less since 2016, we have seen a concurrent deceleration in the efficiency of the flow of top-line dollars to the bottom line.”

Trends® in the Hotel Industry is the firm’s annual survey of operating statements from thousands of hotels across the nation. The 2018 operating data collected for the 2019 survey was compiled in accordance with the 11th edition of the Uniform System of Accounts for the Lodging Industry.

Trends® in the Hotel Industry is the firm’s annual survey of operating statements from thousands of hotels across the nation. The 2018 operating data collected for the 2019 survey was compiled in accordance with the 11th edition of the Uniform System of Accounts for the Lodging Industry.

Labor Expenditures Rise

In 2018, the amount spent to pay employee salaries, wages and benefits at the hotels in the Trends® sample increased by 3.1 percent. This is greater than the 2.4 percent rise for all other operating expenses. For the year, total labor costs equaled 50 percent of operating expenses through GOP. Except for the 2009 great recession, this is the highest this ratio has been in the past 60 years of the Trends® survey.

“Hotel operators have been heroic in their efforts to find employees and combat rising wage rates. However, with the national unemployment rate sinking to 3.9 percent, there comes a time when something must give. With occupancy levels persisting at record high levels, operators must clean more rooms and serve more guests. Automation and productivity enhancements have helped a little, but market conditions indicate that hoteliers must pay the prevailing wage rates, or better, to meet their staffing needs. We do not see this upward pressure on labor costs going away in the near-term,” Corgel observed.

As much pressure as there is on salaries and wages, for the second year in a row, it was the payroll-related component of labor costs that increased at the greatest pace. During 2018, the combined payments made for salaries, wages, service charges, contracted labor and bonuses increased by 3.1 percent, while employee-related benefits grew by 3.2 percent. “Operators are having a tough enough time controlling salaries and wages in a low unemployment environment. It is even more frustrating when the benefits part of the equation, for which they have even less control, is on the rise,” Woodworth commented.

Where Did Profits Grow?

While the profit margin declined, the average hotel in the Trends® sample was able to benefit from a 2.3 percent increase in GOP from 2017 to 2018. All six property categories tracked by CBRE posted increases, but some did better than others.

Limited-service hotels achieved the greatest increase in GOP among all property types during 2018. These hotels were able to convert a 4.3 percent increase in revenue to a 3.5 percent gain in GOP. “Most of the limited-service properties in the Trends® sample operate in the lower-priced chain-scales. In general, the lower-priced chain-scales have lagged in the recovery from the 2009 industry recession, so they are now at a place on the business cycle where they are still able to achieve growth in both occupancy and ADR,” Woodworth said. While limited-service hotels benefited from balanced growth in revenues, the gain in occupancy also brought with it relatively strong growth in expenses. Limited-service hotels saw their operating costs rise by 4.9 percent in 2019, the greatest among all the property-types.

Resort hotels also enjoyed a 3.5 percent gain in GOP during 2018, however, they did so with a slight 0.1 percent decline in occupancy and a strong 4.1 percent gain in ADR. “On average, the resorts in our survey achieved an ADR of $257.16 in 2018. This is the highest ADR of the six property-types we track and reflects the luxury profile of the sample. It also is reflective of another broad trend we observed during the year – the higher the ADR within any given property-type category, the greater the gain in GOP,” Woodworth said.

Strong Profit Levels, But Slow Growth Expected In The Future

“While profit growth has slowed, it should be noted that current GOP margins are 500 basis points above the long-run average and at their highest level since the 1960s. Therefore, if underwritten properly, owners should be receiving nice returns on their investments. Even the slightest gains in profits going forward will maintain these returns,” Corgel said.

Based on CBRE’s March 2019 edition of Hotel Horizons®, RevPAR for U.S. hotels is forecast to increase by 2.5 percent in 2019 and another 2.0 percent in 2020. At this pace of increased revenue, expense growth will have to be limited to less than 4.0 percent to achieve any nominal growth in GOP. “U.S. hoteliers have kept expense increases under 4.0 percent for the past three years, so we believe limited gains on the bottom-line are likely this year and next. However, it will take the extraordinary effort operators have shown to continue to effectively manage costs and, in turn, grow profits,” Woodworth concluded.